Elevate your business

G-Kala brings to you a suite of powerful business solutions and seamless integrations for efficient operations

Open accountElevate your business

G-Kala brings to you a suite of powerful business solutions and seamless integrations for efficient operations

Open accountBulk transfer

Salary disbursement, employee claims, travel expenses , dividend payments, government subsidy etc. we have all payments options available.

- Transfer to multiple bank accounts

- Transfer to multiple wallet accounts

- Transfer salaries to employees with one file upload

- Transfer incentives to employees in every corner of the country

- Easy reconciliation

- Secure and compliant

- Dashboard availability for viewing

Cash management

Online and offline collections in your G-Kala business account, with business dashboards and BI tools

- Collect EMIs, dues, and payments from your customers

- Accept payments online in your account

- Instant settlement for payments through G-Kala account or wallet

- T+1 settlement for the rest of the payment modes

- Automate your collection

- Implement APIs to support your Business needs

- Bills presentment

Bill payment

Pay bills using your phone, web, ATM card etc. for all your utility services

- Pay utility bills through your Business Account

- Payments to vendors

- Get your bill payment dashboard

- Bill presentment

Treasury bills

- T-bills qualify as liquid assets for the purpose of liquidity ratio computation

- Used as collateral securities for repurchase transactions , Interest received not subject to tax, Repayment guaranteed at maturity

- Treasury products includes collections, disbursements, concentration, investment and funding activities all round

Bonds

- Debt security i.e. a long term financial obligation issued through underwriting or auctions by either the government or corporate organisations

- Long term debt instrument , It is listed on the stock exchange and is therefore tradable

- Government bonds are tax free

- An alternate form of investment

- Returns higher than inflation thus good for long term investors

e-Collection

- Customized collections: Gateway that connects merchants, cardholders, and financial institutions

- POS: Facilitates exchange of value between cardholders and merchants. Transactions are carried out with debit, credit cards. Buyer can credit merchant through his or her card.

- Web-based: Online Check out collection methods for e-commerce payments. SME can receive payment directly into their bank account from various platforms.

- NQR: The Nigeria Quick Response Code (NQR), is an online real-time payments and collections platform that supports collections for merchants such that customers make payments for goods and services in a secure, flexible, and seamless manner. Merchants can enjoy stress free, error free collections from their customers in a timely fashion.

- Simplified integration processes with 24 x 7 support through our Customer Interaction centre

- Allows globally accepted means of payment – Verve, VISA and MasterCard

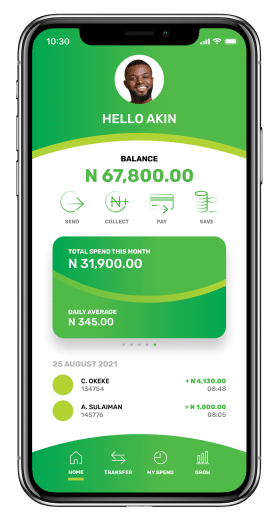

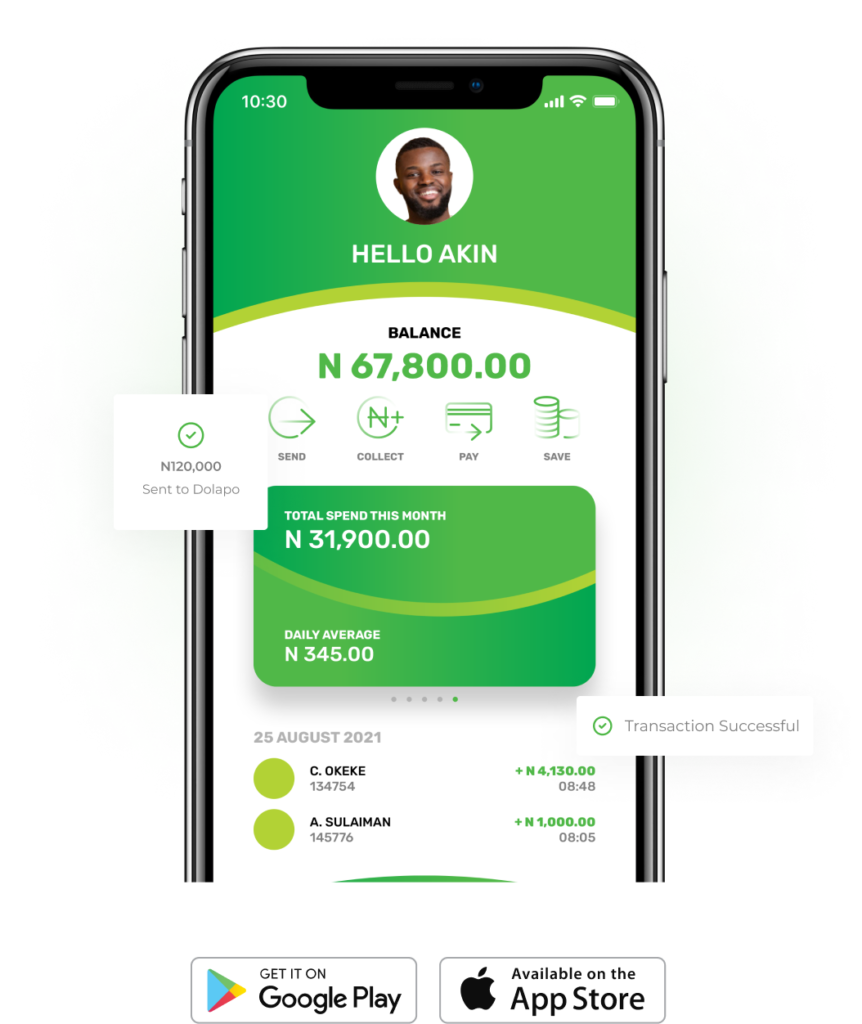

24 x 7 access

Banking access available 24 x 7 x 365 days to ensure your business is operating all the time

- Do your banking 24 x 7 via access to your banking panel

- Safe and secure with Maker and Checker approval layers